Painstaking Lessons Of Tips About How To Stop Loss Order

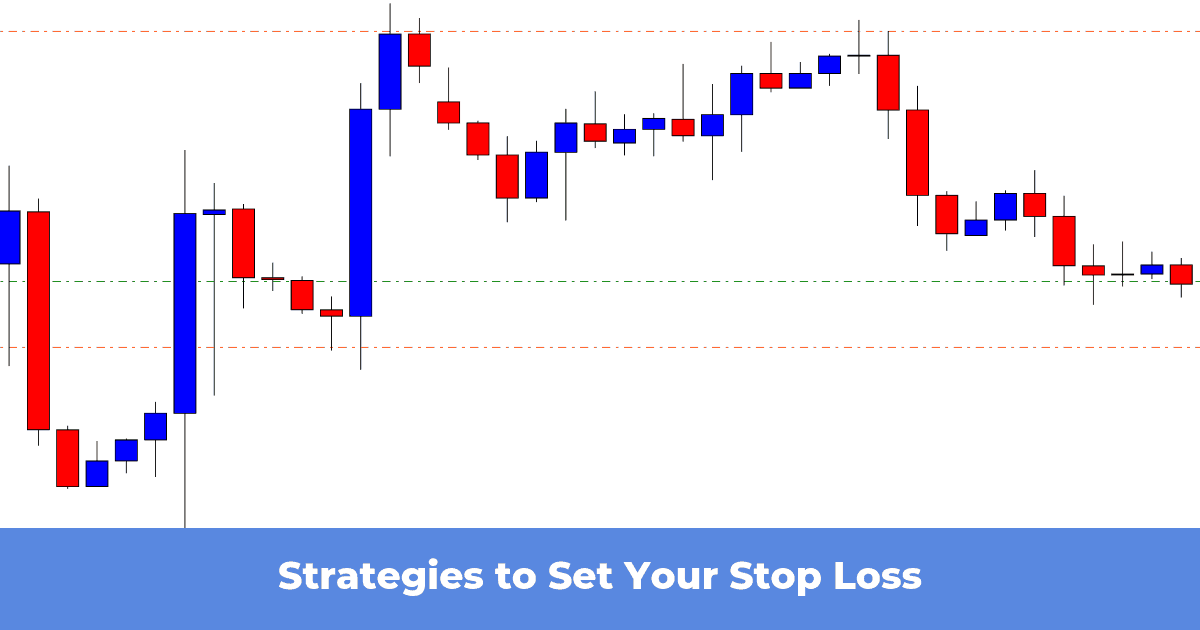

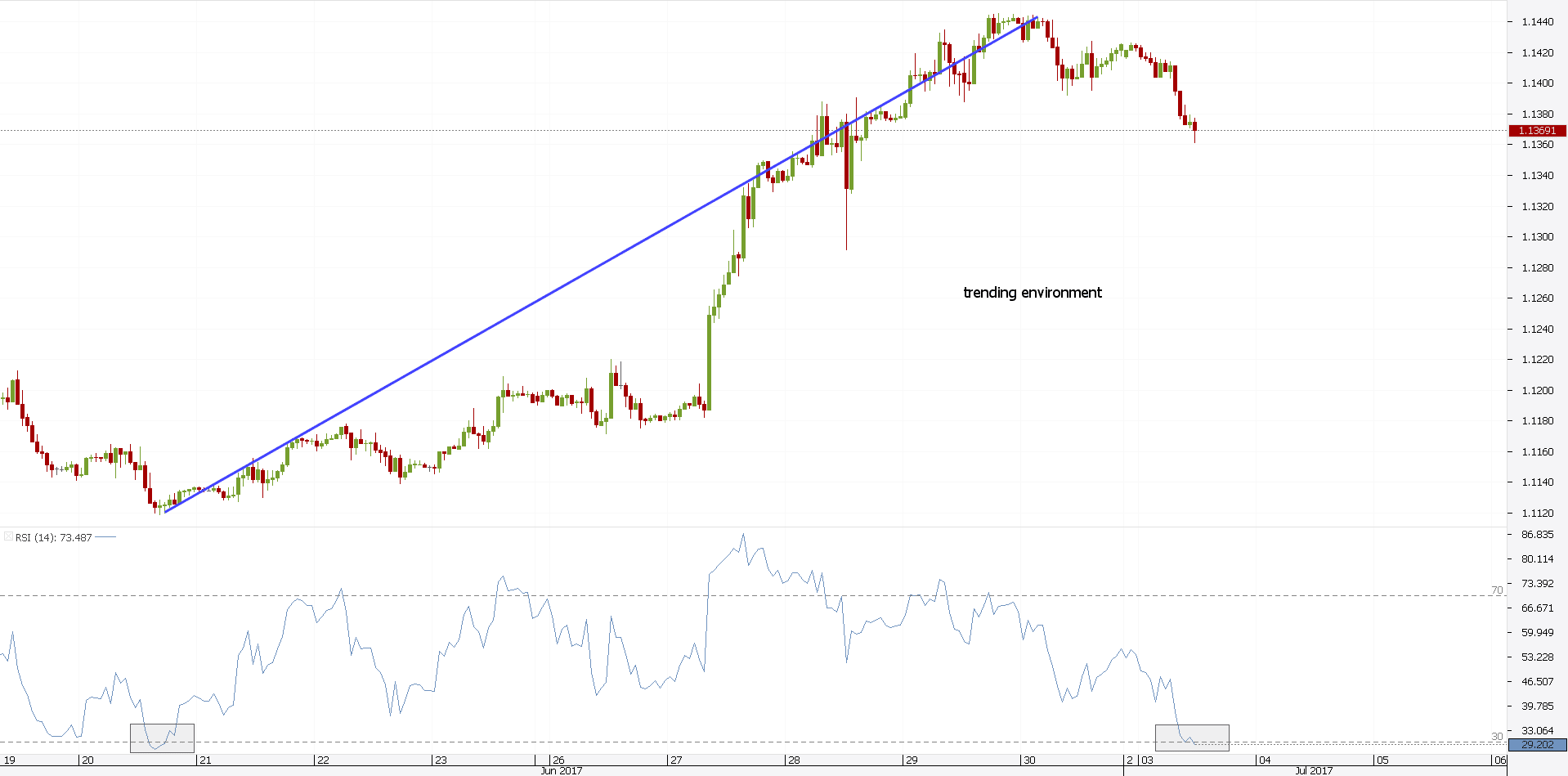

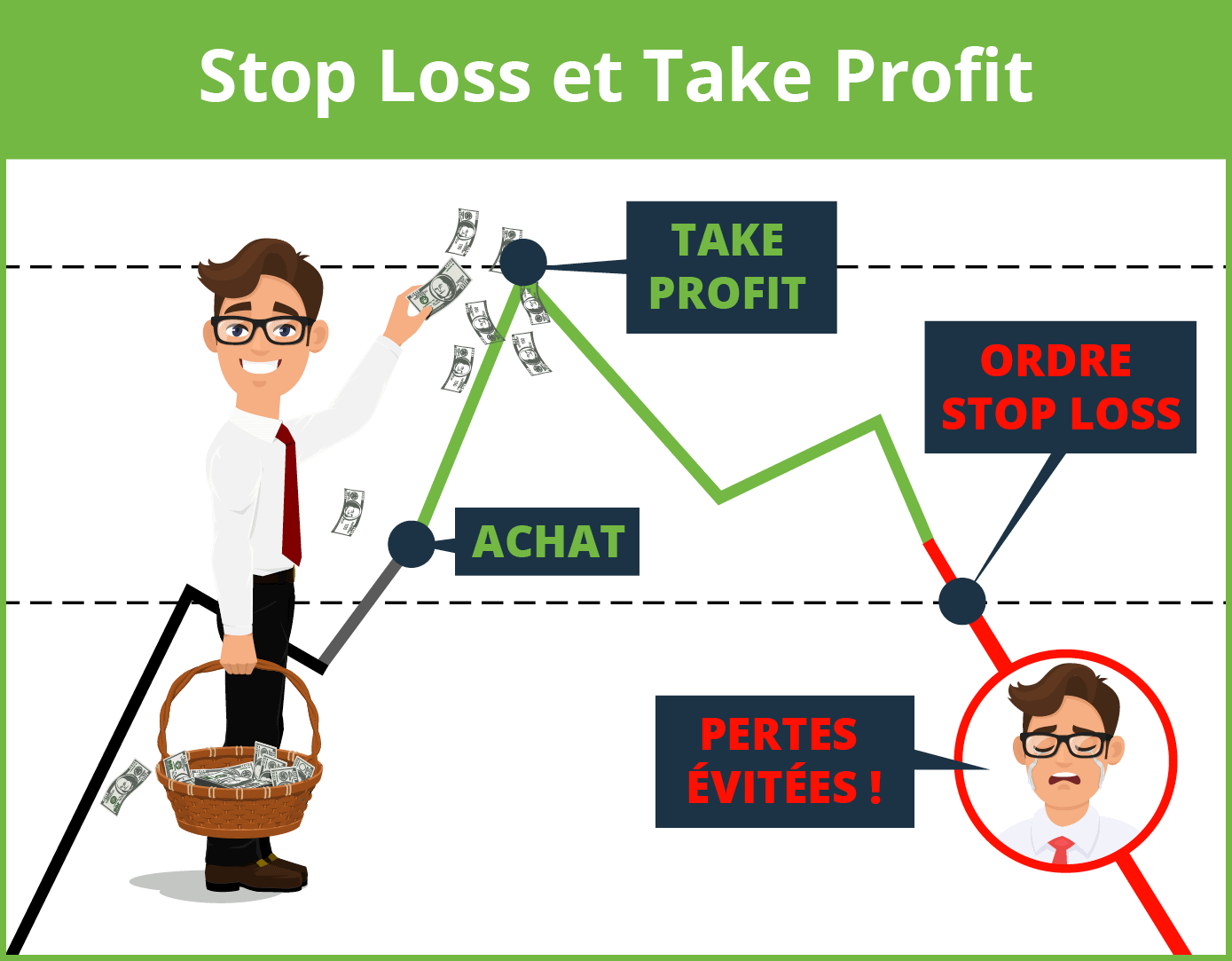

Stop loss and stop limit orders are commonly used to potentially protect against a negative movement in your position.

How to stop loss order. A stop loss order is a popular tool in cfd trading used to limit losses and protect against unfavourable price movements. Set to a predefined price level, a stop. Patrick foot , former senior financial writer december 12, 2022 6:42 am share this:

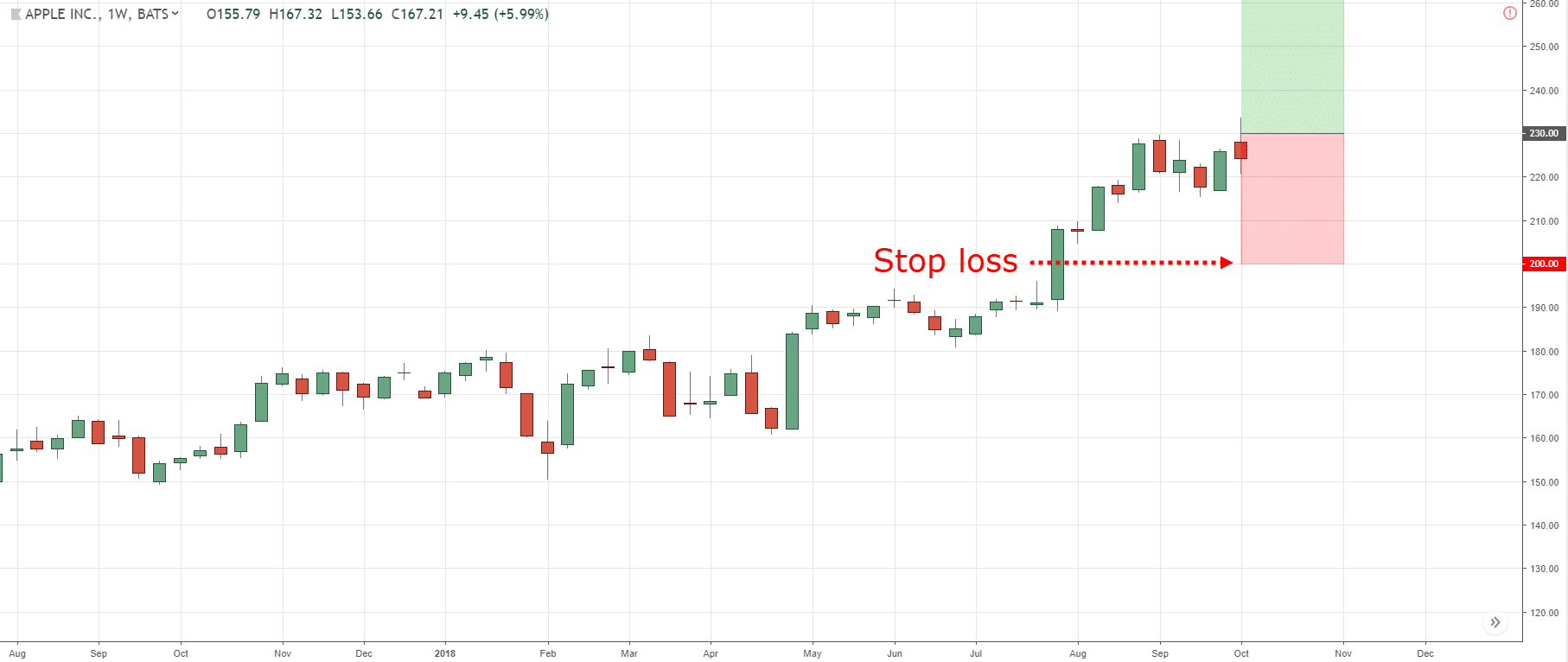

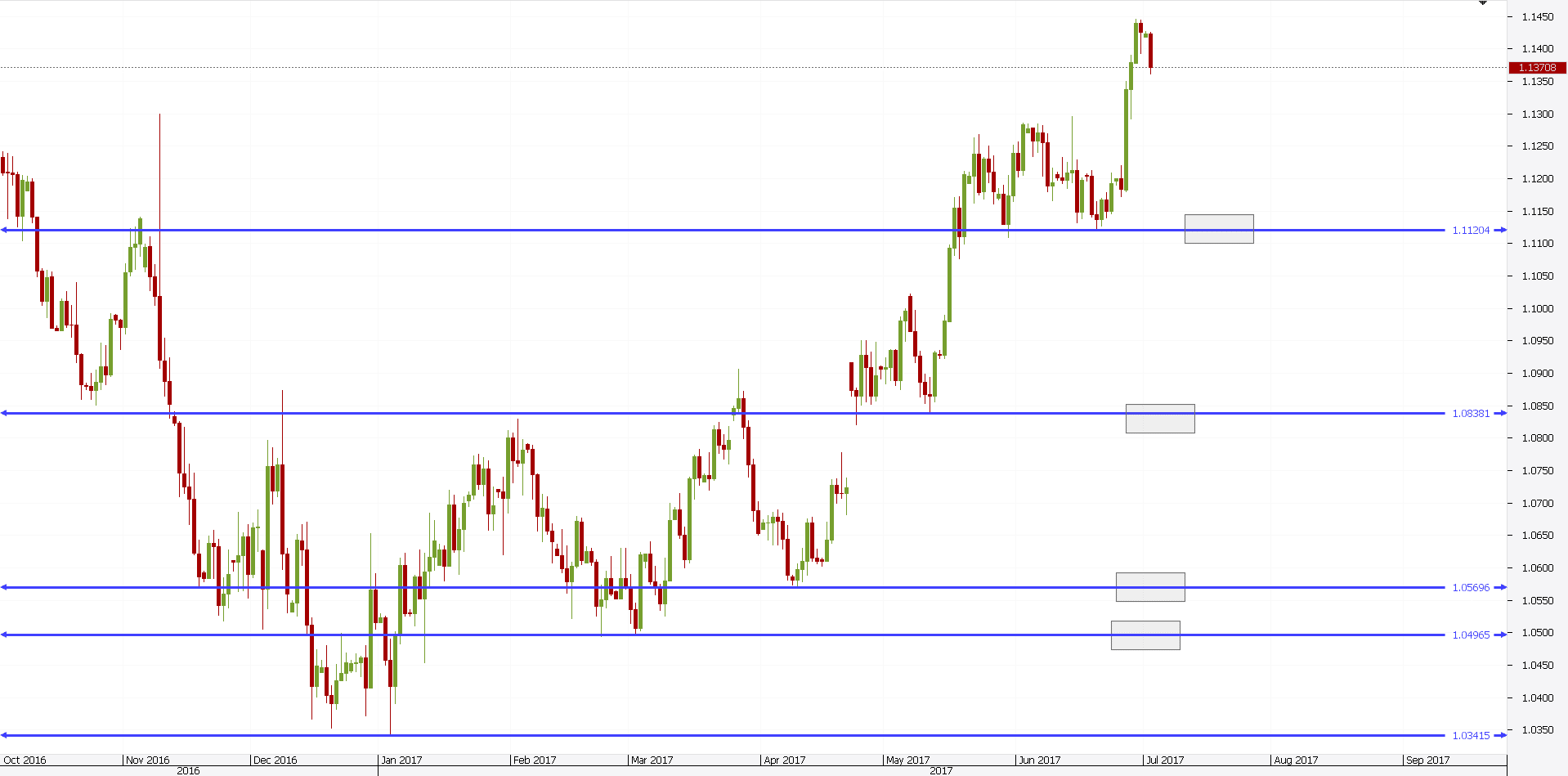

Limit orders, on the other hand, are used to. The size of such stop is derived from the size of the trader’s account. Set the price at which you want your stop loss to trigger.

A stop order is not. Stop orders may help you obtain a predetermined entry or exit price, limit a loss, or lock in a profit. Only if these variables require it, ios will dynamically manage the maximum performance of some system components, such as the cpu and gpu, in order to.

Decide on the price level at which you want your stop loss order to trigger on fidelity. Stop loss orders are used to limit losses and protect against significant declines in the value of an investment. Through that process, the judge could order trump to produce his bank account records, place liens or garnish his wages.

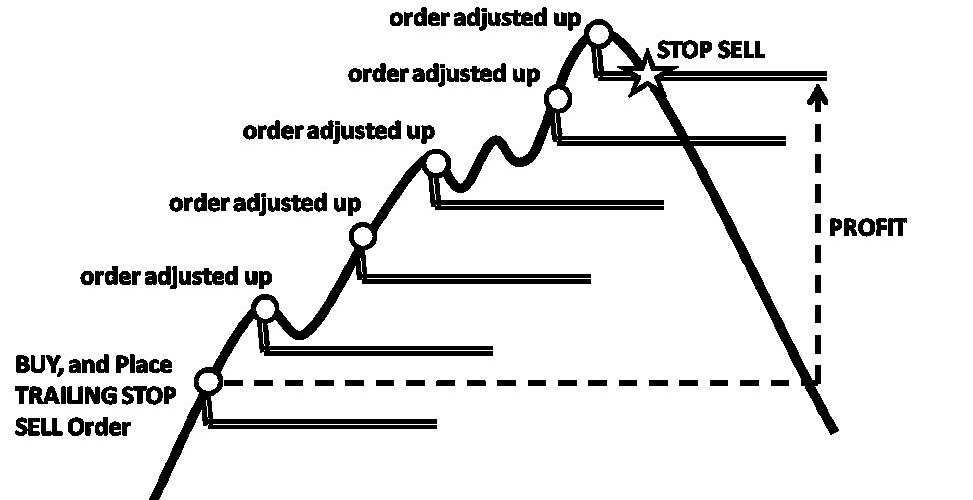

Stop orders are used most often to help protect an unrealized. The system trading method is to place your stop loss order based upon your trading system's risk to reward and win to loss ratios. In other words, if your trading.

It is called the stop price. Stop loss order is a kind of tool that automatically triggers the sale of a certain security when its price reaches a particular level. The most common one is 1% of an.

Trump in his civil fraud case took effect on friday, placing the former president in a precarious. Determine the size of a stop loss order.

:max_bytes(150000):strip_icc()/dotdash_Final_How_the_Trailing_Stop_Stop_Loss_Combo_Can_Lead_to_Winning_Trades_Sep_2020-01-4c3b54bb0ca947608471ea2248542111.jpg)